Diaper Raw Material

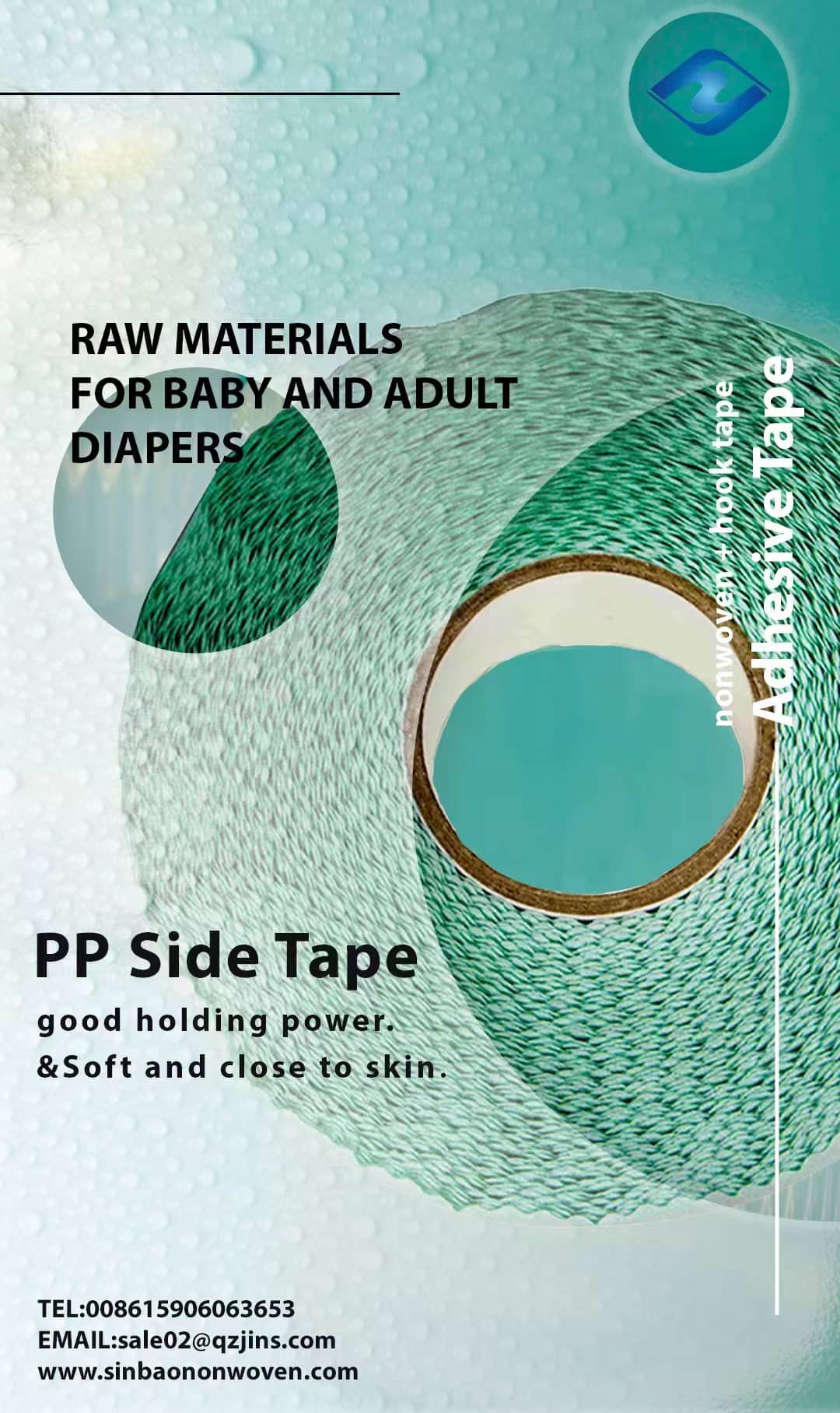

Diaper Raw MaterialThe raw materials of baby diapers include hydrophobic nonwoven fabric, hydrophilic nonwoven fabric, Breathable PE film for baby diapers,PE laminated with nonwoven breathable film for baby diapers, PP Side tape or magic tape, frontal tape for diapers , spandex, hot melt adhesive(rubber hotmelt glue and Structural adhesive for baby diapers), SAP, fluff pulp, tissue paper, elastic waist band etc. Our Xinshun Company can provide one-stop service with high quality and competitive prices to all of you.

Sanitary Napkin Raw Material

Sanitary Napkin Raw MaterialThe Sanitary Napkin Raw Material include fluff pulp, hydrophilic nonwoven fabric,, hydrophobic nonwoven fabric, Breathable PE film, ADL nonwoven , tissue paper, SAP, hotmelt adhesive, easy paste, release paper, PE packaging film for sanitary napkin. Our Xinshun Company can provide one-stop professional service with high quality and competitive prices to all of you.

Wet Wipes Raw Material

Wet Wipes Raw MaterialThe raw materials of wet wipes include spunlace nonwoven fabric, packing film, plastic top cover for wet wipes, hotmelt adhesive, medicinal liquid for wet wipes. Our Xinshun Company can provide one-stop service with high quality and competitive prices to all of you

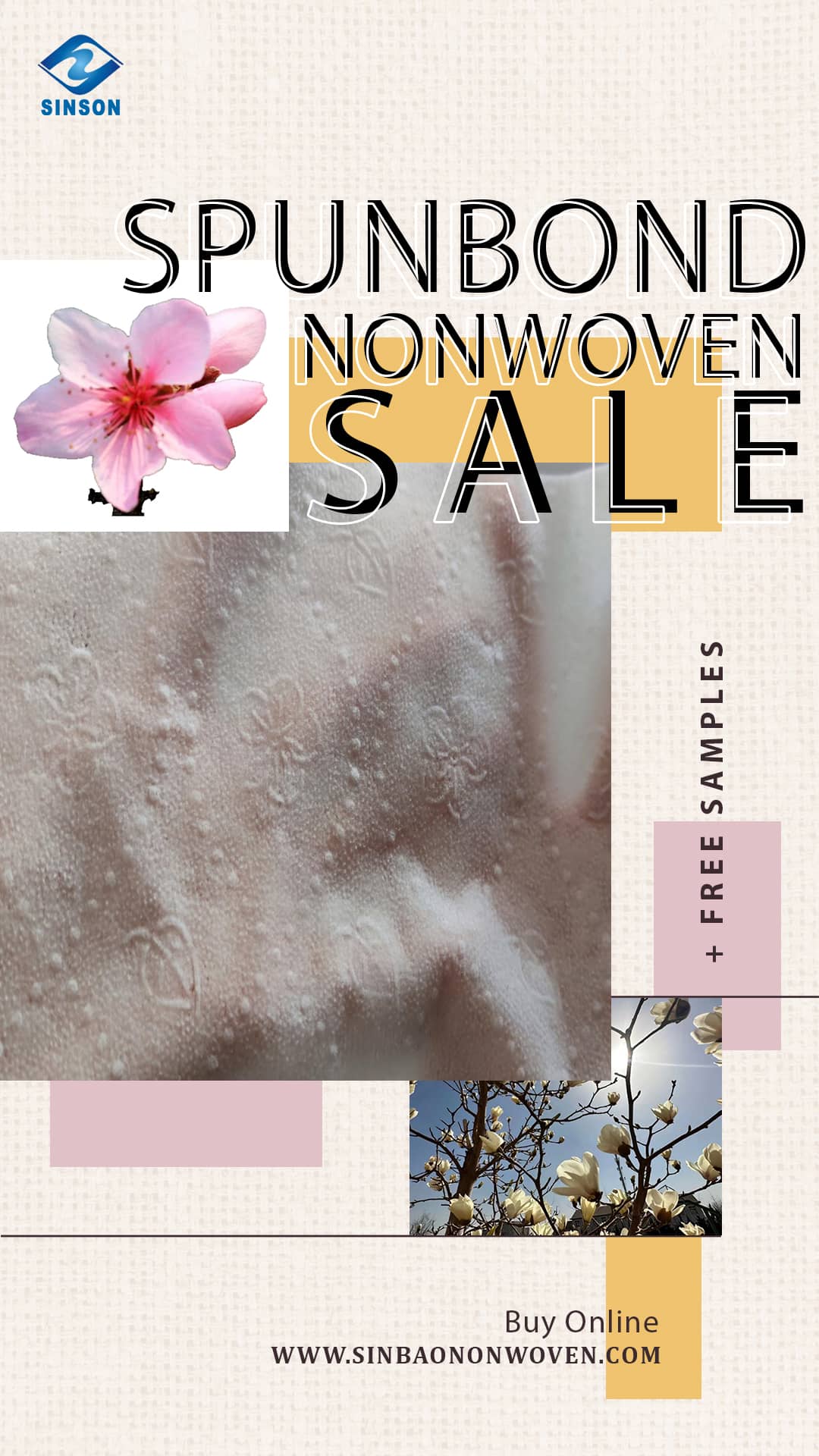

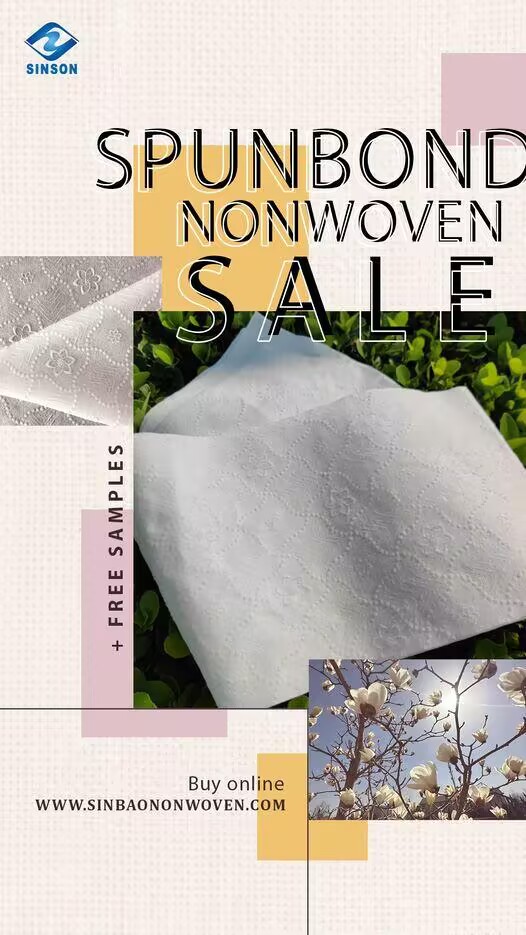

Spunbond Nonwoven

Spunbond NonwovenEco-friendly, water repellent ---can anti-UV(1%-5%), anti-bacteria, anti- static, flame retardant function as requested ---tear resistant, shrink-resistant ---strong strength and elongation, soft, non-toic ---ecellent property of air through

Wholesale Cheap Price Medical Face Protection Masked Making Materials 70gsm Innermost PP Spunbond Non Woven Fabric Characteristic: ---Eco-friendly, water repellent ---can anti-UV(1%-5%), anti-bacteria, anti- static, flame retardant function as requested ---tear resistant, shrink-resistant ---strong strength and elongation, soft, non-toic ---ecellent property of air through

Adults Protective Underwear,It will help to solve your problem.

Characteristic: ---Eco-friendly, water repellent ---can anti-UV(1%-5%), anti-bacteria, anti- static, flame retardant function as requested ---tear resistant, shrink-resistant ---strong strength and elongation, soft, non-toic ---ecellent property of air through

Characteristic: ---Eco-friendly, water repellent ---can anti-UV(1%-5%), anti-bacteria, anti- static, flame retardant function as requested ---tear resistant, shrink-resistant ---strong strength and elongation, soft, non-toic ---ecellent property of air through

China Cheaper Spunbond Nonwoven Roll ---Eco-friendly, water repellent ---can anti-UV(1%-5%), anti-bacteria, anti- static, flame retardant function as requested ---tear resistant, shrink-resistant ---strong strength and elongation, soft, non-toic ---ecellent property of air through

Air Laid Paper Super Absorbent, they are widely use for 1. sanitary napkins/ sanitary pads,nursing pad and Bed sheet 2.baby diaper and adult diapers

High quality polyester viscose nonwoven spunlace wet wipes raw material Spunlace Nonwoven Fabric For Baby Wet Wipes,Spunlace Non-Woven Fabric Roll For Sanitary Wipes This material is made of viscose and polyester.This material is easy to absorb liquid. Anti-bacteria no stimulation and causes no allergy to human body. Low-linting,Highly absorbent,Solvent-resistant. No binders,chemicals or adhesives.

Wet Process Polyurethane Synthetic Leather Spunlace Nonwoven Fabric For Baby Wet Wipes,Spunlace Non-Woven Fabric Roll For Sanitary Wipes This material is made of viscose and polyester.This material is easy to absorb liquid. Anti-bacteria no stimulation and causes no allergy to human body. Low-linting,Highly absorbent,Solvent-resistant. No binders,chemicals or adhesives.

Scan To Wechat